Online share kharidne aur bechne ke liye niche diye gaye steps ko follow karein:

Online share kharidne aur bechne ke liye niche diye gaye steps ko follow karein:

*Online Share Kharidne Ke Liye:*

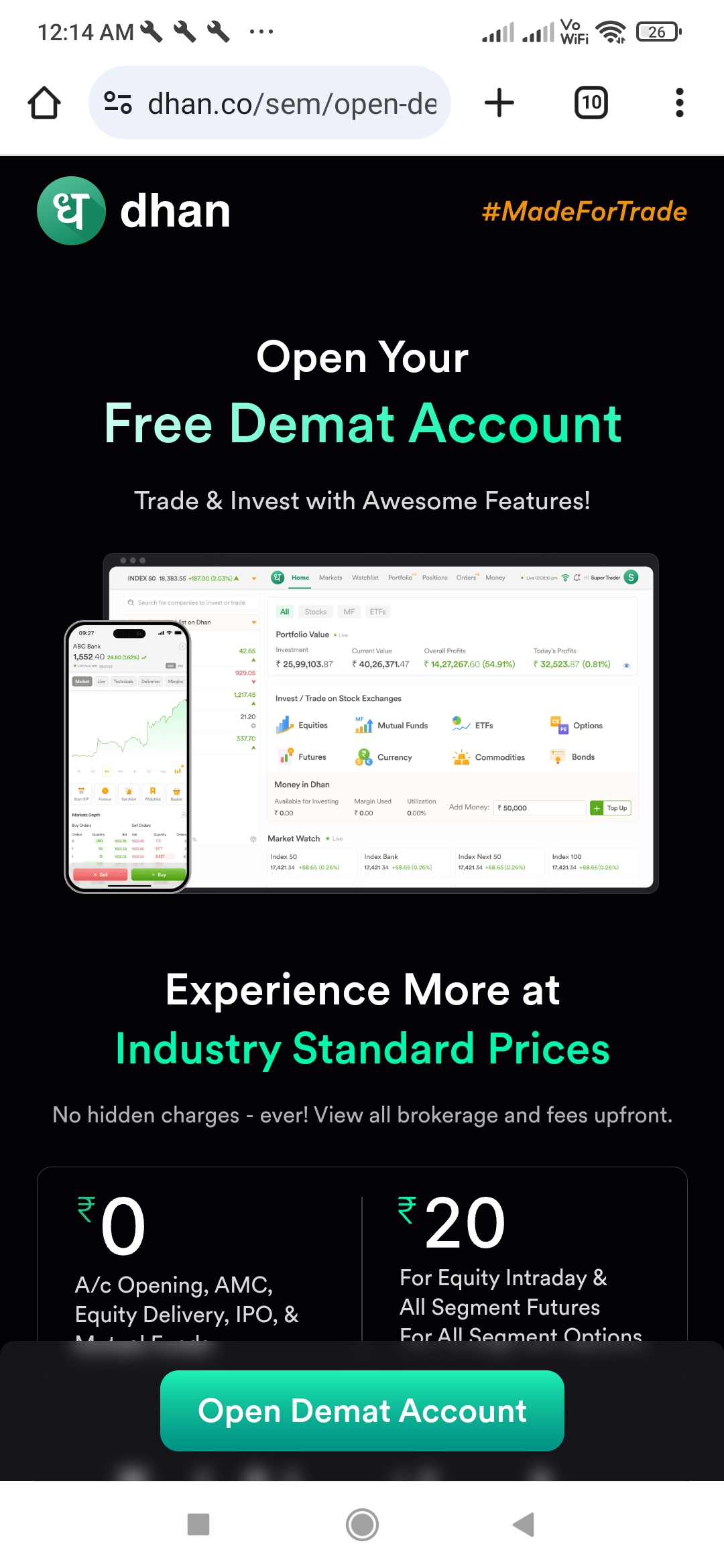

1. Demat account kholen: Kisi authorized broker ke saath Demat account kholen.

2. Trading platform chunen: Online trading platform chunen jaise ki Upstox, Zerodha, aur ICICI Direct.

3. Share chunen: Jise share aap kharidna chahte hain, uska research karen aur chunen.

4. Order place karen: Share ka order place karen, jisme aapko share ka naam, quantity, aur price darj karna hota hai.

5. Payment karen: Share ka payment karen, jiska payment online banking, UPI, ya cheques ke through kiya ja sakta hai.

*Online Share Bechne Ke Liye:*https://app.groww.in/v3cO/h9tpf4m5

1. Demat account mein share transfer karen: Apne Demat account mein share transfer karen.

2. Trading platform par login karen: Apne trading platform par login karen.

3. Share chunen: Jise share aap bechna chahte hain, uska chayan karen.

4. Order place karen: Share ka order place karen, jisme aapko share ka naam, quantity, aur price darj karna hota hai.

5. Payment receive karen: Share ka payment receive karen, jiska payment online banking, UPI, ya cheques ke through kiya ja sakta hai.

*Online Share Market Platforms:*Read more

1. Upstox

2. Zerodha

3. ICICI Direct

4. HDFC Securities

5. Sharekhan

*Safety Tips:*

1. Research karen: Share kharidne se pehle research karen.

2. Risk management: Apne risk ko manage karen.

3. Password secure rakhen: Apne trading account ka password secure rakhen.

4. Online transactions: Online transactions ke liye secure payment methods ka use karen.

*FAQs:*https://app.groww.in/v3cO/h9tpf4m5

1. Online share kharidne ke liye kitna paisa lagta hai?

– Minimum investment Rs. 100.

2. Online share bechne ke liye kitna paisa lagta hai?

– Minimum investment Rs. 100.

3. Online share market mein risk hai?

– Haan, online share market mein risk hai.

Yadi aapko koi problem aati hai, to apne broker ya trading platform ki customer support se sampark karein.

Here’s more information on online share trading:Free mein website banane ke liye niche diye gaye steps ko follow karein:

*Online Share Trading Benefits*

1. Convenience: Trade from anywhere, anytime.

2. Speed: Fast execution of orders.

3. Cost-effective: Lower brokerage charges.

4. Accessibility: Trade in various markets (equity, commodity, currency).

5. Research tools: Access to charts, analysis, and news.

*Online Share Trading Platforms*

1. Upstox: Low brokerage, user-friendly interface.

2. Zerodha: Discount brokerage, advanced trading tools.

3. ICICI Direct: Comprehensive research, flexible trading plans.

4. HDFC Securities: Reliable platform, expert research.

5. Sharekhan: User-friendly interface, competitive brokerage.

*Online Share Trading Process*

1. Open Demat account.

2. Fund account.

3. Choose trading platform.

4. Select shares.

5. Place order (buy/sell).

6. Monitor portfolio. *Online Share Trading Tips*

*Online Share Trading Tips*

1. Set clear goals.

2. Understand risk management.

3. Research thoroughly.

4. Diversify portfolio.

5. Monitor market news.

6. Avoid emotional decisions.

*Online Share Trading Risks*

1. Market volatility.

2. Liquidity risks.

3. Credit risks.

4. Operational risks.

5. Regulatory risks.

*Online Share Trading Regulations*

1. SEBI (Securities and Exchange Board of India).

2. RBI (Reserve Bank of India).

3. Stock exchanges (NSE, BSE).

*Online Share Trading Glossary*

1. Brokerage: Commission charged by broker.

2. Demat account: Electronic holding of shares.

3. Equity: Shares in companies.

4. IPO (Initial Public Offering): First public issue of shares.

5. Portfolio: Collection of investments.

*Online Share Trading Resources*

1. SEBI website ((link unavailable)).

2. NSE website ((link unavailable)).

3. BSE website ((link unavailable)).

4. Trading platforms’ websites.

5. Financial news websites (e.g., Moneycontrol, Economic Times).

Yadi aapko koi problem aati hai, to apne broker ya trading platform ki customer support se sampark karein.